It is a common practice for developments concerning most economic variables to be analyzed containing some missing data. Very often, however, using only the available data and ignoring the problem of missing data, frequently leads to erroneous results with respect to the time dependence in various economic variables. Similar effects should also be expected in the case of the application of various tests based on the available data each time.

Given the above, it is the aim of this short paper to study the effects of missing data in testing simultaneity in structural econometric models. More specifically, we report the results of a Monte Carlo experiment, which examines the effects of missing data on the power of the Hausman (1978) test for simultaneity. On the basis of these Monte Carlo results it appears that as the number of missing data increases, the probability of accepting the null hypothesis of simultaneity using the Hausman test is decreased, especially in small samples of data. As the number of the available data increases, the problem is getting less problematic and after a certain level of available data it disappears.

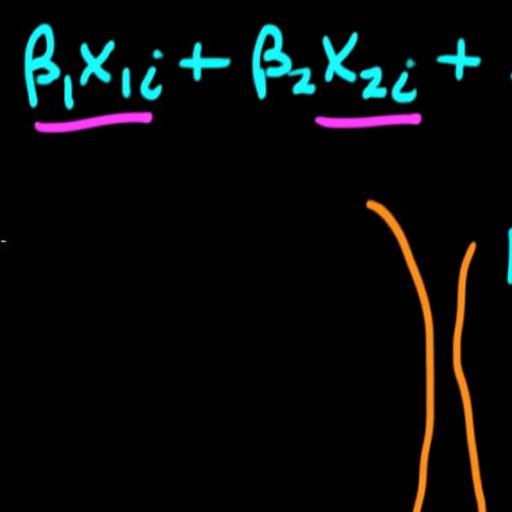

To overcome this problem we use a Full Information Maximum Likelihood missing data approach (Sargan and Drettakis, 1974) to ‘estimate’ the missing data and then use them for testing for simultaneity. According to our Monte Carlo result, the probability of accepting the null hypothesis of simultaneity increases significantly when we use simultaneously the available data and the estimated (retrieved) data for testing for simultaneity, especially in a small sample. The power of the test is more effective as compared to applying the Hausman test in the case where the missing data would have been ignored.

Finally the effects of missing data on the power of the Hausman 1978 simultaneity test disappear as the number of the total observations increases, independently of whether we ignore the missing data or we use the suggested missing observations technique to retrieve them.