During the last decade, the mutual fund industry has experienced remarkable growth because of the benefits it offers to individual investors. By investing in the appropriate mutual fund instead of creating and managing an individual portfolio, investors can achieve greater diversification and professional management at reduced cost. As a result of this trend, an increasing proportion of the liquidity that is directed in and out of stock markets is the result of the decisions of fund managers, rather than individual investors. The hypothesis then to be tested is whether institutional investor flows have a direct influence on the movements of the stock prices around the world.

This investigation has both a theoretical interest related to the efficient market hypothesis, as well as a practical one, from the standpoint of market stability and sound investment decisions, therefore a large number of papers has focused on such issues1. However, there has been relatively less research on the relationship, if any, between stock returns and mutual fund flows in the Athens Stock Exchange2. We may mention the papers of Caporale, Phillipas and Pitis (2004)3 and Alexakis, Niarchos, Patra and Pshakwale (2004), which provide analytical evidence for a bidirectional linear causality between mutual fund flows and stock returns over a period of nine years, combining causality tests and generalized response analysis .

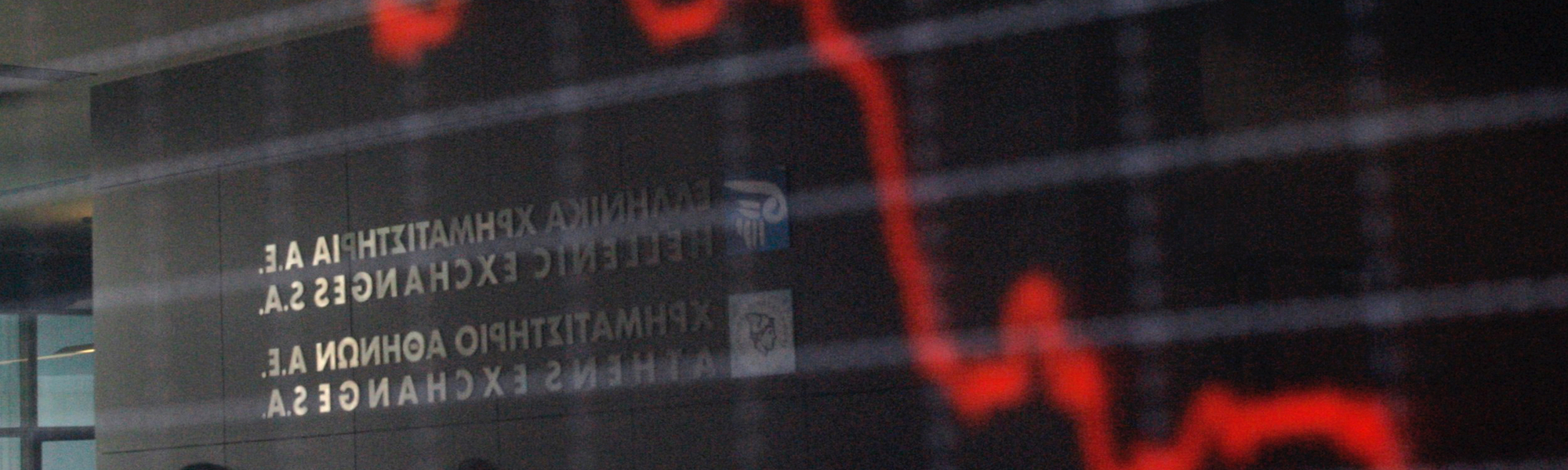

This paper examines the interaction between mutual fund flows and stock returns in the Athens Stock Exchange. More specifically, it investigates the existence of a nonlinear causality mechanism in which mutual funds may affect stock returns and vice versa. This paper confirms and extends the results of the above two mentioned papers by using a different methodology, a more extended time period and a different measure of mutual fund flows. Using the standard linear causality procedure of Hsiao’s (1981) with the help of the Box-Cox transformation, we provide analytical evidence and formulate a bidirectional nonlinear causality between mutual fund flows and stock returns. Further, possible feedbacks from international capital markets have been taken into account by including in the analysis the Dow Jones Index. This is very important as the omission of relevant variables can bias causality inference.