It is common practice for developments concerning most economic magnitudes to be analyzed on the highest level of temporal disaggregation. Very often, however, the available data correspond to high levels of time aggregation, which frequently lead to erroneous results with respect to the diachronic dependencies in various economic variables and the powers of some tests. In fact, it is not uncommon to arrive at different results even when using the same magnitudes with different temporal aggregation. Similar effects should also be expected in the case of the application of some time domain tests used widely to test for the functional specification between economic variables.

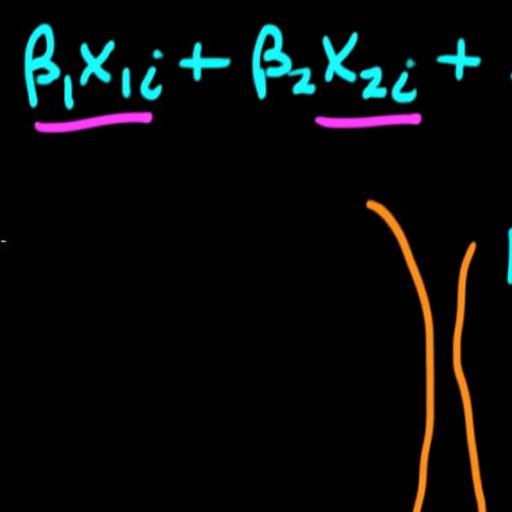

The temporal aggregation effects on the power of Ramsey‟s (1969) RESET test have been studied not in extend in a paper of Clive W. J. Granger and Tae-Hwy Lee (1999)3. These authors concluded that aggregation is inclined to simplify nonlinearity. Given the above, it is the aim of this paper to study the effects of time aggregation on the power and the size of the Ramsey‟s (1969) RESET test. More specifically, we report the results of an extended Monte Carlo experiment which examines the effects of using data at different level of time aggregation on the power of the Ramsey‟s (1969) RESET test. An empirical application of the temporal aggregation effects on testing the functional form using the Ramsey‟s (1969) RESET at different temporal aggregation levels, is presented with the well example of capital expenditures and appropriations.