This short paper examines the diachronic interaction between the Advance/Decline ratio index (henceforth A/D index) and the returns of the General Index of the Athens Stock Exchange (GI). More specifically, it investigates the existence of a linear or nonlinear causality mechanism by which the A/D ratio index may affect stock returns and vice versa.

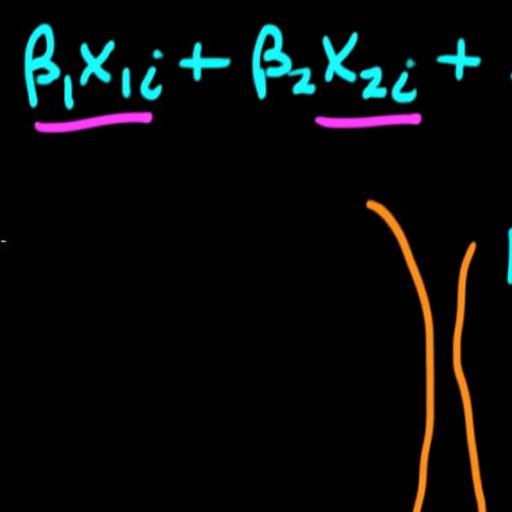

The A/D index is the ratio of the number of stocks that closed higher to those that declined in value for a particular trading day and it is widely accepted as an indicator of market strength. It is published daily along with other market data and it has been adopted by many technical analysts to support their technical analysis charts. Whether or not one agrees with technical analysis methodologies and predictions, the A/D index does represent useful information that is published daily by the Exchange. We can formulate two hypotheses regarding the meaning / representation of the A/D index: according to the first one, H0, the ratio reflects the dynamics of the market during a given day and any information available to market participants is expressed simultaneously in both the General Index and the A/D index. If this hypothesis holds, then we should not expect to find a causal relationship from the General Index to the A/D index or vice versa. This hypothesis is consistent with the efficient markets hypothesis.