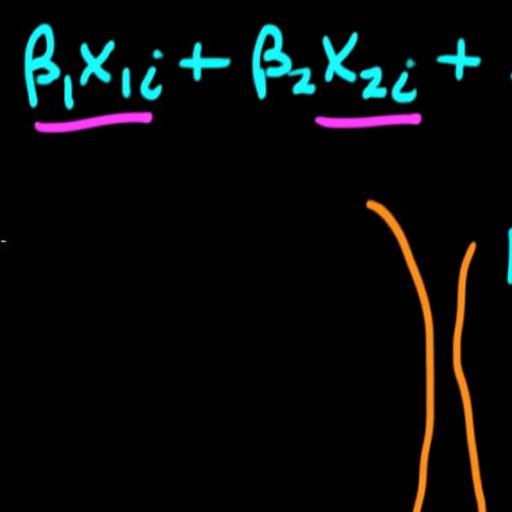

Following Schmidt and Sickles (1984) and much subsequent literature, we consider a fixed effect panel data production function. The production frontier is defined by the best firm, which is the one with the largest value of θi, and one measure of the technical inefficiency of a given firm is the difference between the best firm’s intercept and the given firm’s intercept. We will consider this case in more detail in Section 4 below. However, there are many other settings in which comparison with the best may be appropriate. One example is a drug trial, in which θi is the mean survival time (or some similar parameter where a larger value is better) given treatment with drug i. Suppose there is an existing standard drug plus a number of new possible drugs. We might be interested in comparing any one of the new drugs to the existing standard drug. However, we might also be interested in comparing new drugs with the best drug in the set. For example, a comparison with the best might be appropriate if one of the new drugs is very expensive and therefore is justified only if it is clearly best. Hsu (1996) gives a number of other examples, such as the effectiveness of insect traps and the comparison of SAT scores across academic units.

Marginal Comparisons with the Best and the Efficiency Measurment Problem

In this paper we are interested in the problem of comparisons with the best population. One case where comparisons with the best arise naturally is the measurement of productive efficiency.

See also

-

Testing the Linearity of a Time Series

-

Temporal Aggregation and the Ramsey's Test for Functional Form: Results from Empirical and Monte Carlo experiment

-

Temporal Aggregation and Systematic Sampling Effects on Non Linear Granger Causality Tests between Trade Volume and Returns. Some Monte Carlo and Empirical Results from the Athens Stocks Exchange.

-

Non-Linear Diachronic Interaction Between the Advance/Decline Ratio Index and the Returns of the Market's General Index: Empirical Evidence from the Athens Stock Exchange