The investigation of the effects of movements in the general price level of a stock market on the economic development of a country as well as the role of inflationary pressures on GDP growth are issues that have preoccupied and continue to be of interest to researchers of modern applied economics and policy makers alike. In this paper we attempt an investigation of non-linear relationships between the changes of the real Gross Domestic Product of the Greek economy (GDP) on the one hand and the returns of the Greek stock market and the rate of inflation on the other. Using quarterly data and simple statistical tests of linearity/ non-linearity, we are able to statistically verify the existence of non-linear effects of stock market returns and inflation on the determination of the real GDP of the Greek economy.

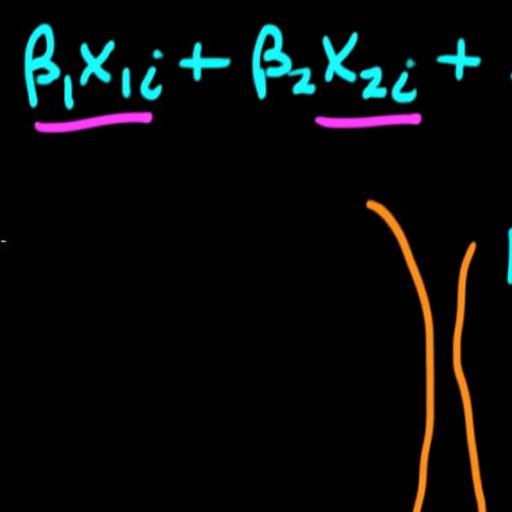

Next, we attempt to establish the direction of causality between the variables under examination. In order to investigate the existence and direction of causality we did not use the typical methods which are based on the use of models with different time lags to pinpoint the presence and direction of causality. As discussed in section 2 below, the typical causality tests distribute the effects among the economic variables involved and establish simplified causal relationships, often attributing causality in the presence of co-determination. In the methodological section (section 2) of this paper, we demonstrate, using simulated data, that in the presence of non- linearity the typical causality investigation models that use different time lags, often distribute the effects among the variables and identify at best simplified causality which is in fact due to the co-determination among the variables.